Check out these retirement planning tips for steps to determine how much you need saved for retirement, and be sure your planning is on track.

Check out these retirement planning tips for steps to determine how much you need saved for retirement, and be sure your planning is on track.

Many retirement experts estimate how much you’ll need saved for retirement – near $1 million, 80% to 90% of your pre-retirement income, or 12 times your pre-retirement salary – however, your retirement needs are specific to you. There are many factors to consider, including your current age, the age at which you’ll retire, the status of your health, potential job loss or circumstances beyond your control, how much you’ll spend in retirement, and what your retirement income will be. Consider these retirement planning tips when deciding how much money you’ll need to save for retirement.

-

Determine how much you will need in retirement.

A good monthly retirement income is based on an understanding of what your retirement needs will be. Use this retirement calculator to see an estimate of your monthly income during retirement. Having a realistic idea of what you’ll be spending in retirement can help avoid overspending. Start by estimating the expenses you’ll have in retirement.

-

Projected living expenses

- These expenses can range from transportation, food, healthcare, to utilities and where you will live. For example, food expenses – both eating at home and dining out – can cost around $550 a month. To help minimize these costs, try collecting coupons, creating and sticking to a shopping list, buying generic brand items, and taking advantage of any senior discounts.

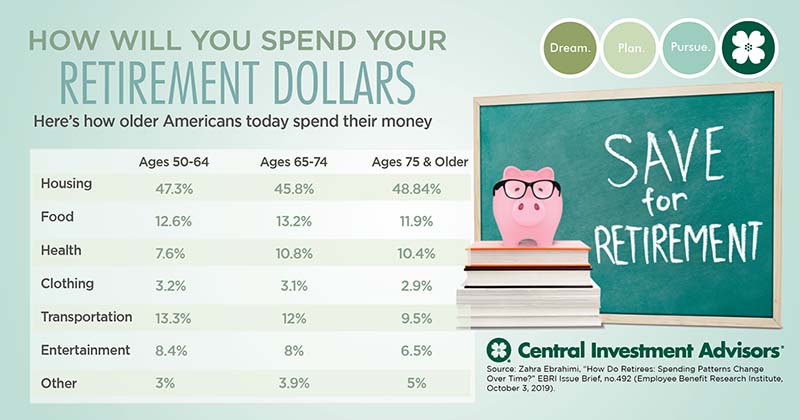

Use this chart for an idea of how your expenses for housing, food, health, transportation, clothing and entertainment may change during retirement. In addition, if you have plans to travel, or spend more time and money on a hobby, it’s a good idea to factor in costs for more discretionary expenses.

-

Life Expectancy and Health Care Expenses

- Health care costs continue to be one of the most expensive costs in retirement. With costs rising, it’s important to factor when you’ll stop working, timing of taking Social Security, the timing of your benefits, and making sure your cash flow can help cover expenses. Some experts recommend having $300,000 after tax saved, however, the amount you’ll need depends on when and where you’ll retire, your health status, and how long you’ll live. If you’re still working and your employer offers a health spending account, like a Health Savings Account (HSA), this will help you tax-efficiently save for healthcare costs. HSAs save pretax dollars, and possibly employer contributions, to grow funds and you can withdraw tax-free for eligible health care expenses. Funds in the HSA rollover year to year if you don’t spend them, and your HSA may earn interest which is not taxable. These eligible expenses can range from deductibles, copayments, coinsurance, and medical supplies.

-

Property Costs

- Where do you plan on living in retirement? Staying in your home, moving to a retirement community, or something in between? Some of the largest expenses for retirees are housing costs, which include mortgage, rent, property taxes, insurance, maintenance, and repairs. The average retiree household may pay an average of 33% of total annual expenditures on housing costs.

-

Retirement Lifestyle

- Your lifestyle in retirement not only depends on your assets and investment choices, but also how quickly you draw down on your portfolio. This is known as a ‘withdrawal rate’ and is the annual percentage you take out of your portfolio, whether from returns or the principal itself. The amount of money you take out can have a significant impact on how long your savings will last. Your withdrawal rate is especially important in the early years of retirement – take out too much too soon, and you may run out of money in the later years.

View and download our free Retirement planning guide for the basics of retirement planning.

-

-

Pick a retirement Account-

-

Employer-Sponsored Retirement Accounts

- These saving options generally include 401(k) and Roth 401(k) plans, SIMPLE IRA plans, and SEP plans; and allow employees a way to automatically save for retirement while benefitting from tax breaks. Most employers that offer retirement savings options reward employees who participate in these programs with a matching contribution. If your employer offers to match a percentage of your contribution, be sure you’re contributing enough to qualify for the full match.

-

Individual Retirement Accounts (IRAs)

- Individual Retirement Accounts (IRAs) are a retirement savings account with tax advantages, and can include traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs. There are contribution limits depending on your tax filing status and income limit. IRAs are designed for anyone who has earned income to save long-term for retirement – you won’t be able to withdraw funds before the age of 59 ½ without incurring a tax penalty of 10% of the amount you’re withdrawing.

-

-

Choose Your Investment Vehicle

- Mutual Funds – Owns a portfolio of assets and sells shares to investors. Mutual funds are made of investors who purchase securities like stocks, bonds, money market instruments, and other assets. A fund manager, or whoever you appoint to manage your portfolio, actively manages mutual funds in an attempt to product capital gains or income for the investor.

- Indexed Funds – Money in an index fund is used to invest in all the companies that make up a particular index. So instead of investing in one company, the money you invest is tied to the performance of a wide-range of companies, which can help diversify your portfolio.

- Exchange-traded funds (ETFs) – Similar to a mutual fund, exchange-traded funds (ETFs) track a particular index or asset. However, ETFs can be purchased or sold on the stock exchange like a regular stock. You can structure an ETF to track the price of a specific security or collection of securities, as well as specific investment strategies. Unlike mutual funds, the price of ETFs can fluctuate all day as it is bought and sold.

- Target Date Funds (TDF) – Include a mix of several different types of stocks, bonds, and other investments you can actively or passively manage depending on your retirement timeline. Typically, the further away from retirement you are, the riskier the investment may be. As you get closer to retirement, the fund can move toward lower risk options.

CERTIFIED FINANCIAL PLANNER™ professional (CFP®)

- – To help manage your advisory-based accounts, consider enlisting help from a CFP®. These professionals can help you when planning for retirement, create and implement a financial plan tailored to your current financial situation, personal preferences, and comfort with risk. When thinking about how to select a retirement financial planner, it’s important to work with someone knowledgeable who will communicate with you, understand your short and long-term goals, and help you make wise decisions.

-

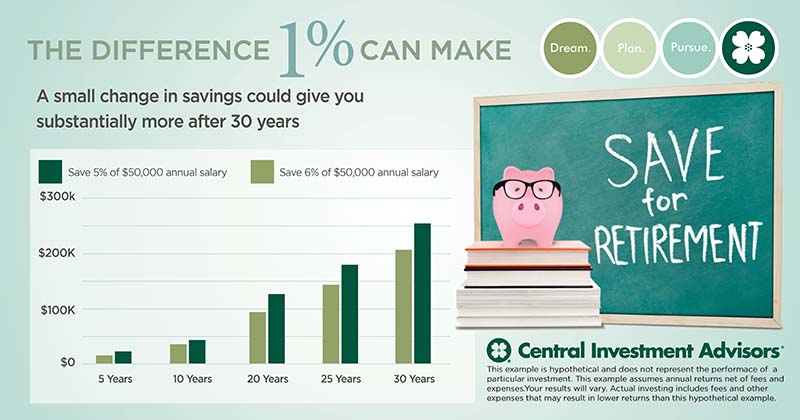

Consider a yearly retirement contribution increase.

Even a small change in your saving strategy could make a big difference, especially 20 or 30 years down the road. Check out our free investment calculator to see how much an increase in savings could yield in the future. In addition, generating tax-free income in retirement can help minimize your tax bill, and provide more income to cover your other expenses.

-

Remember to think long-term when saving for retirement. –

There are many factors to consider with your investment portfolio, especially when it comes to factors outside your control, such as market volatility. A higher volatility means an asset’s price could change dramatically over a short period of time – either positively or negatively.

Having an experienced, knowledgeable retirement financial planner who is used to an ever-changing market can help you stay on track. When visiting with an advisor, use these questions to ask a retirement financial planner. It’s important to work with an advisor who understands that why you are investing is as valuable as the assets in which you invest. Check out Our Advisors to find a Retirement Planner near you.

Investing involves risk including the potential loss of principal. This material is intended for informational purposes only, and is not intended to be a substitute for specific individualized advice, as situations will vary.

Indexes are unmanaged. It is not possible to invest directly in an index.

The principal value of a target fund is not guaranteed at any time, including the target date. The target date is the approximate date when investors plan to start withdrawing their money.

Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 591/2 may result in a 10% IRS penalty tax in addition to current income tax.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Category: Retirement