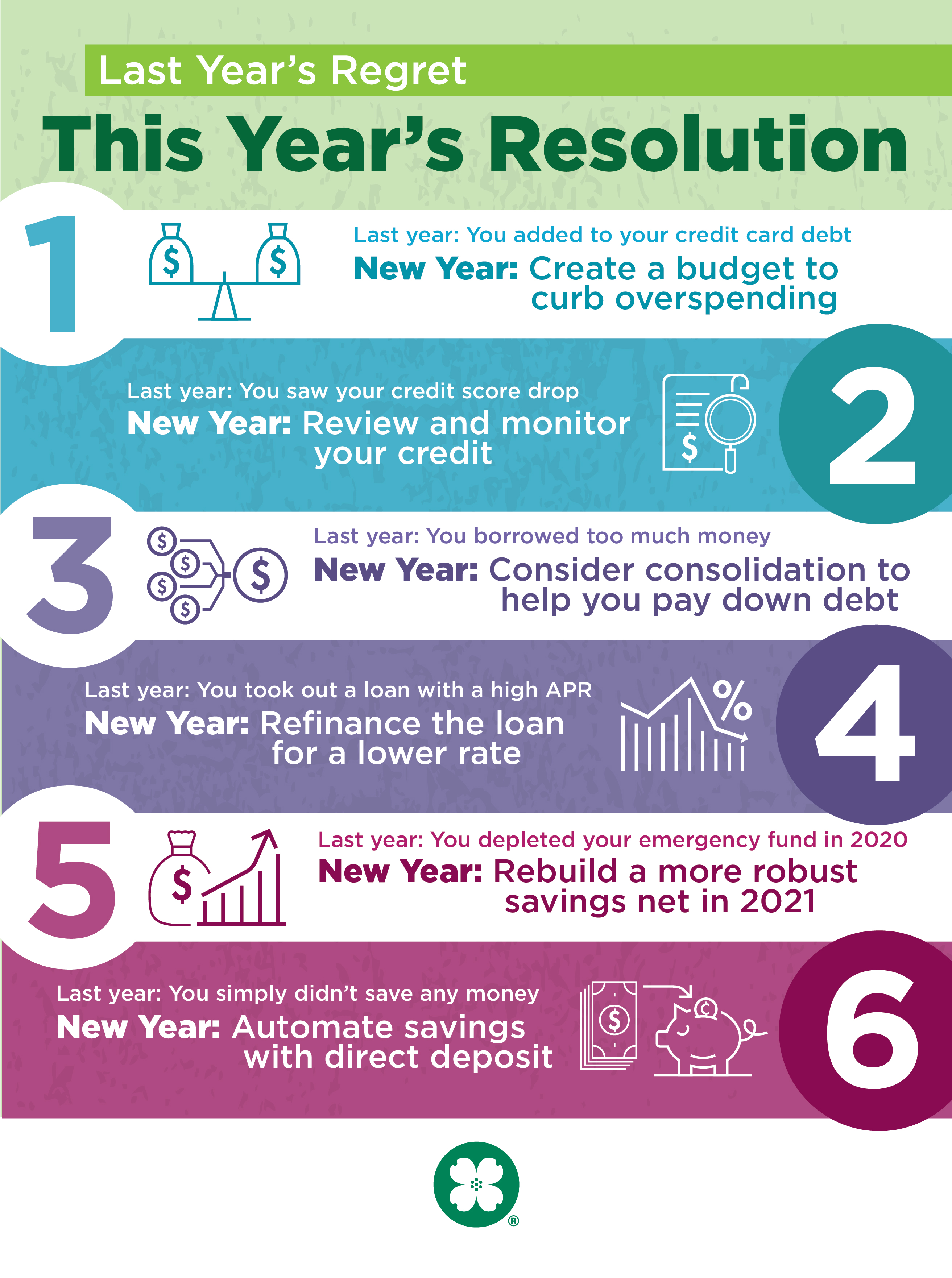

The New Year is a good time to evaluate your financial goals. Consider these tips when thinking about your New Year’s Resolutions.

The beginning of a New Year can be a beneficial time to evaluate your short and long-term goals, as well as reflect on what you accomplished during the year.

Here are a few tips to consider when thinking about your financial resolutions.

Create a Budget

Tracking your expenses gives you a better picture of the money you earn, spend, and save. Be sure your budget includes how much you’re taking in after taxes, how much you’re spending, and how much you’re saving.[1] If the thought of creating a budget is daunting, consider starting small with a monthly budget. By creating a monthly breakdown, you can evaluate your money situation on a smaller scale, and practice good habits one at a time.

Look at your bank account or credit card statements to see where you’re spending money. Keeping track of your money is the key step in improving your financial well-being. Evaluate your fixed expenses with your variable expenses.[2]

-

Fixed expenses

are payments that remain the same each month – mortgage or rent payment, auto loan payments, health insurance premiums, student loans, internet or streaming services, etc. -

Variable expenses

are payment amounts that can vary – gasoline, groceries, utilities, dining out, clothing, gifts, etc.

Also, a big part of your budget should include planning for essential big-ticket items.[1] Putting away money for big expenses like a new roof, HVAC repairs, or college tuition can help you keep your budget on track. By treating that money as ‘spent,’ you won’t need to worry when it’s time for those expenses. If you know you'll need the money in a few years, consider investing in a short-term financial vehicle like a Certificate of Deposit (CD), savings account, or money market account.

Manage Any Debt

Debt can sometimes be a necessity if you’re planning on purchasing an expensive, long-term asset, such as a house or vehicle. However, it’s important to keep a manageable load of debt, and not let it take control. Here are a few solutions to consider for common financial regrets.

Determine where you can shave costs, whether it’s dining out less frequently or bringing your own coffee to work instead of buying from your favorite coffee shop. When planning your trip to the grocery store, consider making a list and shopping in bulk. Coming up with the meals you’ll eat during the week will help you determine the groceries you need to purchase, instead of browsing the aisles and potentially spending more money. Also, try using cash when doing any shopping. Cash only allows you to spend the amount you have, and research shows physically handing over money and watching it disappear is painful.[3]

Start a Side Hustle

To help decrease any debt, consider starting a side hustle. Evaluate your skills and see what type of side job would be a good fit. Maybe you cleaned out your house and have items to sell on eBay or Facebook Marketplace. Some popular side hustles include food delivery, ridesharing, online freelancing, or even tutoring.[4] Think about the types of things you enjoy doing in your free time, and consider how you could use that to earn money. Maybe it’s knitting clothing items and selling them, or sewing masks to sell online.

No matter what you choose to do, be sure to evaluate any potential costs, and be sure it will give you a good return on any initial investment. And who knows, maybe you’ll uncover a passion or new hobby!

Optimize Your Portfolio

We’re all striving to get the most from our investments, and sometimes the timing of markets can be difficult, and counter-productive. It can help to create a plan, and adjust to fit your goals.[1]

First off, focus on your overall investment mix. Once you determine your savings plan, look at your targeted asset allocation. This is the overall mix of stocks, bonds and cash in your portfolio. Are these assets in sync with your long-term goals, risk tolerance, and time frame?

-

Diversifying

- Diversifying your portfolio can help reduce your risk, and help you achieve your goals. Mutual funds and exchange-traded (EFTs) include different assets and are popular ways for investors to diversify. You can trade EFTs like stocks, while you’re only allowed to purchase mutual funds at the end of the day based on a calculated price.[5] -

Consider Taxes

- Look at placing tax-efficient investments, like EFTs and municipal bonds, in taxable accounts. Consider putting tax-inefficient investments, like mutual funds and real estate investment trusts (REITs) in tax-advantage accounts. If you trade frequently, tax-advantaged accounts can help reduce your tax bill.[1] -

Monitor and Rebalance as Needed

- Evaluate your portfolio twice each year to be sure it’s performing the way you need. The long-term progress you make toward your goals are more important than expecting immediate success. Whether you’re saving for tuition costs or retirement, consider reducing investment risks so you won’t need to sell more volatile investments, like stocks, when you need the funds.[1]

Start Saving for Retirement

It’s never too late to start saving for retirement! Start contributing to your retirement plan, such as a 401(k). This is a common retirement plan many employers offer, so check with your employer to begin contributing. Also, consider increasing your contributions in small increments, like one or two percent of your paycheck at a time, until you find a limit in which you’re comfortable.

There are many factors to think about when it comes to planning your retirement. Saving and investing options, inflation, Social Security benefits, and more. Check out our Retirement Planning Guide for help in how to get started.

Sources:

[1] New Year's Financial Resolutions: Get Your Finances in Shape for 2021, Charles Schwab

[2] Is Debt Consolidation a Good Idea?, Lending Tree

[3] Paying With Cash Can Help You Save Money, CNBC

[4] 15 Best Side Hustles You Can Start Earning With Now, The College Investor

[5] Mutual Fund vs. ETF: What's the Difference?, Investopedia

Investing involves risk including the potential loss of principal. No investment strategy, including diversification, asset allocation and rebalancing, can guarantee a profit or protect against a loss.

CDs are FDIC insured to specific limits and offer a fixed rate of return if held to maturity, whereas investing in securities is subject to market risk including loss of principal. Brokered CDs sold prior to maturity in the secondary market may result in loss of principal due to fluctuations in the interest rate or lack of liquidity.

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

Investing in mutual funds and ETFs involves risks, including possible loss of principal. Fund value will fluctuate with the market conditions and it may not achieve its investment objective. ETFs carry additional risks such as not being diversified, possible trading halts, and index tracking errors.

Investing in Real Estate Investment Trusts (REITs) involves special risks such as potential illiquidity and may not be suitable for all investors. There is no assurance that the investment objectives of this program will be attained.

The information provided in these articles is intended for informational purposes only. It is not to be construed as the opinion of Central Bancompany, Inc., and/or its subsidiaries and does not imply endorsement or support of any of the mentioned information, products, services, or providers. All information presented is without any representation, guaranty, or warranty regarding the accuracy, relevance, or completeness of the information.

Category: Markets & Economy