Dollar cost averaging (DCA) is an investing strategy, which can lower the amount you pay for assets. Here’s what you need to know.

What is Dollar Cost Averaging?

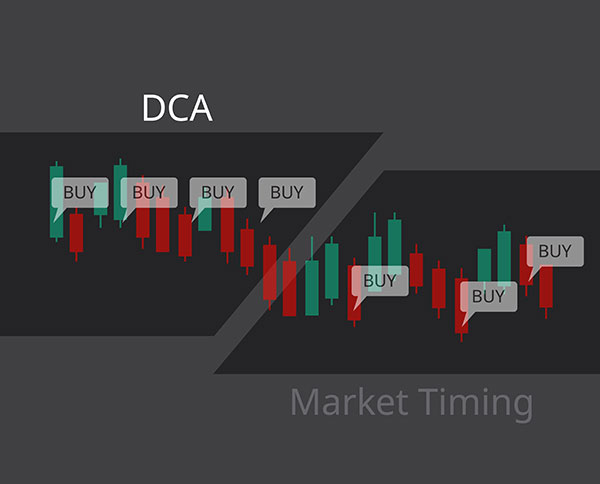

Dollar cost averaging (DCA) is a strategy for investing, which can help minimize risk and lower the amount you pay for investments. With DCA, you consistently purchase smaller investment shares at regular intervals, as opposed to timing the market. On a long-term basis, dollar cost averaging can help decrease the asset purchase price.

How Dollar Cost Averaging Works

Dollar cost averaging is a way to make your money work consistently, which is a major factor in long-term growth. Traditionally, you might invest in a certain asset at one time, for one price. With dollar cost averaging, you split up the money you want to invest and buy smaller quantities of the asset at regular periods.

You can potentially lower your average purchase price by buying equal dollar amounts over time because you can buy fewer shares when prices are high, and more shares when prices are low. A good example of this is a 401(k) plan, which makes regular purchases regardless of the price of any given equity within the account. As a result, you may end up with more shares of an asset, and the opportunity to purchase more shares at a lower price per share. This can benefit your long-term strategy since you’ll own more shares, and if the asset increases in value, you’ll see a higher return.

Dollar cost averaging also allows you to invest even if the market is down. This can help in maintaining your investing strategy, since investing during market dips can be intimidating. In addition, DCA takes more of the emotional decision–making out of investing. If you were to withdraw your existing investments during a down market, you could potentially miss out on future returns.

Market Timing vs Dollar Cost Averaging

Over a long term, asset prices usually tend to rise. However, asset prices do not rise consistently in the short term. This can result in short-term highs and lows, which may not follow a predictable pattern. So, what does that mean for your investing strategy? It can be difficult, nearly impossible, to determine how the market will act in the short term – highs and lows are all relative. Meaning, what’s at an all-time high right now, may be a fairly low price next week. And this week’s low, may be a high price in a month. In hindsight, you can see what would have been a good time to purchase an asset, but unless you have a time machine, it’s too late.

Trying to time the market can be expensive. If you’re waiting for the asset price to decrease, you may end up buying at a price where the asset plateaued after it already made significant gains. In a study, “Does Market Timing Work” by Charles Schwab in September 13, 2023, financial experts found those who tried timing the market earned less yield, than those who consistently invested with dollar cost averaging.

Who Should Use Dollar Cost Averaging?

You can invest with a smaller amount of money using dollar cost averaging, instead of needing a large amount to invest at once. This strategy can benefit anyone, specifically if you want to begin investing with a smaller amount of money.

Dollar cost averaging is beneficial if you are:

- Starting to invest, and have a smaller amount of money to buy shares

- Making regular contributions to a retirement account, like 401(k) or IRA

- Not likely to continue investing during a down market

- Unsure about market timing and researching best times for investing

Prefer to Work with a Professional? Here’s How an Advisor can Help

It’s important to keep in mind no strategy is 100% guaranteed. While there are many benefits to dollar cost averaging, it may not be the best fit for your portfolio. According to research from the Financial Planning Association in June 2004, (Lump Sum Beats Dollar-Cost Averaging), over an even longer term, dollar cost averaging may not outweigh traditional lump sum investing.

However, your situation and needs are unique – what’s right for you, may not be right for someone else. This is where your financial advisor can help you figure out a plan best suited for you. Financial advisors may have different skills, training, and qualifications, so it’s important to ask these basic questions when searching for an advisor.

As always, we’re here to help you make the most of your money. We offer no obligation consultations, so you can find the right advisor for your needs.

Dollar cost averaging involves continuous investment in securities regardless of fluctuation in price levels of such securities. An investor should consider their ability to continue purchasing through fluctuating price levels. Such a plan does not assure a profit and does not protect against a loss in declining markets.

The information provided in these articles is intended for informational purposes only. It is not to be construed as the opinion of Central Bancompany, Inc., and/or its subsidiaries and does not imply endorsement or support of any of the mentioned information, products, services, or providers. All information presented is without any representation, guaranty, or warranty regarding the accuracy, relevance, or completeness of the information.

Category: Wealth Planning