Use these retirement planning tips to prepare for unexpected expenses in retirement. From home repairs to health care costs, here’s what to know.

You’ve worked hard planning for retirement – from saving and investing, to considering your longevity and health care expenses. But what about unforeseen costs?

Every dollar counts in retirement, and while you might have budgeted for emergencies, surprise costs can affect your overall retirement plan. Consider these common, sometimes unexpected, costs to keep your retirement planning on the right track.

Home Repairs or Remodel

Housing and living expenses are among the most expensive costs retirees face. These costs can include a mortgage payment, insurance, and maintenance costs. Research from the Society of Actuaries found that one of the most surprising expenses for retirees is the cost of home repairs.

Planning on doing some home remodeling or projects? With a little extra time on your hands, retirement can be a popular time to take on home projects. If you’re considering renovating your kitchen, or updating the bathrooms, it’s important to plan out those costs. During your retirement planning, get an estimate of any home improvement projects you’re wanting to tackle. How much money will it actually take to accomplish what you’re wanting? Be sure to include those expenses in your retirement plan – including the amount of what it will cost, and if you plan to hire help or do it yourself.

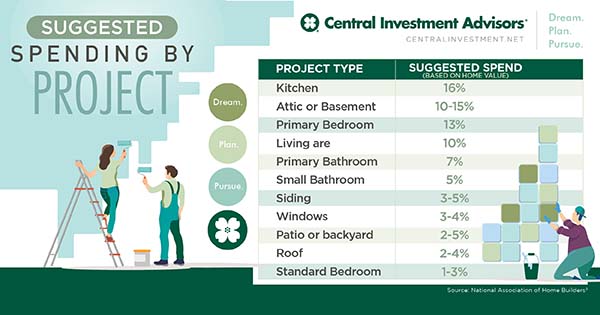

According to the National Association of Home Building, here is a chart to calculate the suggested spend on a project, based on the value of your home:

Uncovered Health Care Costs

Regardless of your age or current health status, it’s a good idea to start planning now for health care in retirement. From health insurance options to Medicare and Long-Term Care, there are different types of coverage to consider. Even with Medicare, health care costs can be expensive and surprising. Aside from home repairs, the other most expensive surprise for retirees was the cost of major dental expenses.

Original Medicare includes Part A and Part B, which covers hospital stays and routine doctor visits. Many other services for hearing, dental, and vision care, as well as copays and prescription drugs are not included. To receive complete coverage, you may need supplemental plans, which are an additional cost.

However, there are tax-advantaged ways you can save for health care costs. If you’re not eligible for Medicare, or are still working, consider opening a Health Savings Account (HSA). HSAs save dollars pre-tax, as well as any employer contributions, for you to use toward eligible health care expenses. Eligible expenses can include deductibles, copayments, coinsurance, and medical supplies.

A Child or Grandchild in Crisis

If your child needs financial help, it's natural to want to step in and help. Many parents are helping their adult children in some way – from cell phone bills and groceries, to paying for wedding expenses. However, the older you become, the more difficult it is to bounce back from larger expenses.

In fact, half of parents who are financially supporting an adult child or grandchild say it’s putting their retirement savings at risk, according to a survey from Bankrate. While wanting to help a loved one is commendable, doing so at the risk of jeopardizing your retirement does not benefit anyone. Instead, if you want to help your adult children, make sure not to give an amount greater than or outside the scope of your normal spending.

In addition, there are ways to help a grandchild with education expenses that won’t risk your retirement savings.

It’s important to help adult children learn the skills needed to be successful with money. While life events or emotions can make cutting the money cord difficult, you’re helping them become self-reliant adults.

What to consider when cutting the money cord:

-

Come up with a plan and timeline

– Before bringing this up to your loved ones, consider a plan of how to reduce or eliminate funding – including gradually cutting back spending, and a date to officially stop assisting financially. -

Prepare for conversation

– Sometimes these types of conversations are uncomfortable, and can be confusing for your adult child. It’s important to be transparent about why you’re needing to do this – to save your retirement – and that it’s not a punishment for your child. -

Be clear about your plan

– When talking with your adult child, let them know about your plan and timeline, in order to give them enough time to prepare. Depending on the amount of support you give, they could need anywhere from a few months to a year’s notice. -

Offer support in other ways

– Even when you’re no longer financially supporting your adult child, let them know you’re happy to help in other ways. Consider offering to help them come up with new ways to generate income, look for a higher-paying job, or if you know any networking opportunities.

Losing a Spouse

Sometimes the death of a spouse is completely unexpected – there is no way to prepare for the emotional shock of losing your special loved one. While household income may drop as a result, there are steps you can take to prepare financially.

- Evaluate life insurance policies

- Research survivorship options with pensions

- Surviving spouse is eligible for Social Security benefits

In addition, review your estate plan and make any updates to help smooth the transition of assets.

Women typically live longer than men – on average, a 65-year-old woman can live until 85-years-old. That would equate to roughly 21 years in retirement, making it important for your nest egg to be able to support a longer retirement.

Even with proper planning, emergencies happen – making it important to adjust your strategy to accommodate those needs. By being aware of these types of unexpected expenses, you can better prepare and spend less time needing to worry about paying for your daily needs. Remember how resilient you are, and be ready to make adjustments. As always, we’re here to help you every step of the way – contact us to find a retirement financial planner near you.

Although the information has been gathered from sources believed to be reliable, its accuracy cannot be guaranteed. This material is intended for informational purposes only and is not intended to be a substitute for specific individualized planning advice.

Category: Retirement