A good credit score is important to your financial health. Here’s how to build and maintain your credit score.

You’ve probably already heard about how important a good credit score is to your financial health. But how important is a good credit score as you get older?

Does your credit score still matter if you don’t need a mortgage, car or student loans, or any new credit cards? Most financial experts agree good credit matters at any age. You never know when an unexpected expense may arise, and you need a good credit score for borrowing purposes.

Whether it’s going back to work, getting a lower insurance premium, financially helping out a child, or cosigning a loan.[1] Here’s how to build, improve, and maintain your credit score.

What is a Credit Score?

Your credit score is a three-digit number that estimates how likely you will repay borrowed funds and pay new bills.[2] The higher a score, the better a borrower looks to a lender.

Credit scores are determined from your credit information, which evaluates and calculates your score based on your:

-

Payment history

- the most important factor in your credit score is if a lender trusts you to repay funds they loan to you. Have you paid your bills on time? If you were late, how late? The later your payment = the worse the effect on your credit score. Also, any closed accounts due to overdrawn funds, debt settlements, bankruptcies, foreclosures, lawsuits, wage garnishments or liens, are undesirable marks from a lender’s perspective.[3] -

Amount you owe

- this measures how much debt you have compared with your available credit limits. How much of your available credit do you use? Less is better, however, owing a small amount can show lenders you’re responsible and stable enough to pay back any amounts you borrow.[3] -

Length of credit history

- how long have you been using credit? This factor evaluates the length of your oldest credit account. A longer credit history is helpful, if maintained responsibly, but a shorter timeframe can be okay as long as you make payments on time and don’t owe too much. Because length of credit history is a factor in your credit score, personal finance experts recommend leaving credit card accounts open, even if you aren’t using them anymore.[3] -

New credit opened

- your score considers how many new accounts you have, and when you last opened an account. Any time you apply for a new line of credit, lenders usually do a “hard inquiry” which checks your credit information during the credit review process. Hard inquiries can cause a temporary decline in your credit score. If the scoring model sees several new accounts in a short amount of time, it reads that as a greater credit risk. People experiencing cash flow issues or planning to take on more debt, may be more inclined to open several accounts in a short period.[3] -

Types of credit you have

- consider your different credit types, such as a mortgage, auto loans, credit cards, or installment loans. Credit scoring tools factor in your mix of credit and that you use them responsibly. It also looks at the total amount of your accounts. This is a smaller component to your score, so don’t open new accounts just to increase your mix of credit types.[3]

What is Considered a Good Credit Score?

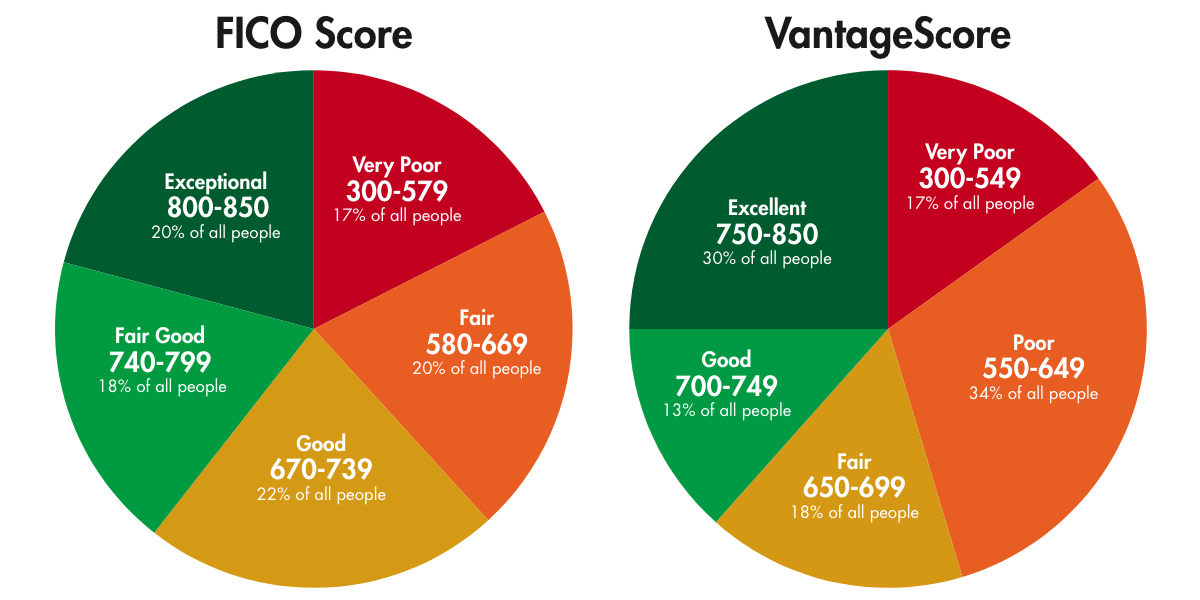

That’s a good question. Many different scoring models exist, and a lender may use a certain scoring model based on the product in which you’re applying.

A credit score is a three-digit number, on a scale that ranks credit scores from low to high. Because of the different scoring models, these scales can range from 300-850, 250-900, and some start at 265. Lenders view borrowers with higher credit scores as more creditworthy.

-

Scores 600 and less

are considered “subprime borrowers.” Lenders will often charge interest on subprime mortgages at a higher rate than a conventional mortgage because of the risk factor for the lender. Lending institutions may also require a shorter repayment term or a co-signer.[4] -

Scores 700 and higher

are generally considered good and can result in a lower interest rate, which means you’ll pay less in interest over the life of the loan.

Different scoring models exist, and creditors can define their own ranges for credit scores. Some lenders will follow the FICO scoring model, and some will follow the Vantage scoring model.

On the FICO Scoring Model:

- Exceptional: 800 to 850

- Very Good: 740 to 799

- Good: 670 to 739

- Fair: 580 to 669

- Very Poor: 300 to 579

On the Vantage Scoring Model:

- Excellent: 750 to 850

- Good: 700 to 749

- Fair: 650 to 699

- Poor: 550 to 649

- Very Poor: 300 to 549

How to Improve or Maintain Your Score

The factors mentioned above are all key to your credit score, but a few carry more weight. Here’s a breakdown of the factors and their impact on your score:

- Payment history = 35%

- Amount you owe = 30%

- Length of credit history = 15%

- New credit opened = 10%

- Types of credit you have = 10%

Pay Your Bills on Time

The easiest way to improve your score is to make any payments on time. Paying on time, every time, will boost your credit score. Also, medical bills will negatively impact your score if you don’t pay them on time. A late payment 30 days or longer past the due date, will stay on your credit history for seven years.[2]

Keep Your Credit Utilization Low

Weighted almost the same as paying on time, is the amount of balances you owe. It’s best to avoid using more than 30% of your credit limits.[2] Usually, the lower the amount you owe, the better. However, once credit bureaus receive a lower credit utilization figure, a high credit utilization stops hurting your credit score.

Check Your Credit Regularly

Keeping a close eye on your credit score and credit report will help you know if there are any changes. Additionally, checking your credit score on a regular basis can help you spot any problems that may arise and help you correct them if necessary. A good resource for checking your credit score is by visiting AnnualCreditReport.com.

Besides looking for any errors or inaccurate information, you can make sure no new accounts are listed that you did not authorize – this could be a sign of identity theft.[5]

If you notice any discrepancies or errors on your credit report, be sure to file a dispute with the appropriate credit reporting company – Experian, Equifax, and/or TransUnion. Explain in writing what you think the error is, and include copies of documents that support your dispute.

For more information on disputing an error on your credit report and contact information, check out the Consumer Financial Protection Bureau’s website on disputing an error on your credit report.

Limit Your Number of Open Credit Accounts

Having a mix of credit types is good for your credit score, and shows lenders you can manage different types of credit. However, too many credit applications in a short period can negatively impact your score. A constant stream of hard inquiries can cause lenders to view you as a credit risk.

When you apply for credit, be sure you understand your creditworthiness. Consider only applying when you think you have a high chance of being approved, and only when you need the credit.[5]

Sources:

[1] Does Credit History Matter After 50?, AARP

[2] What Is a Credit Score, and What Are the Credit Score Ranges?, NerdWallet

[3] The 5 Biggest Factors That Affect Your Credit, Investopedia

[4] Credit Score, Investopedia

[5] 4 Simple Habits That Build Good Credit, Experian

The information provided in these articles is intended for informational purposes only. It is not to be construed as the opinion of Central Bancompany, Inc., and/or its subsidiaries and does not imply endorsement or support of any of the mentioned information, products, services, or providers. All information presented is without any representation, guaranty, or warranty regarding the accuracy, relevance, or completeness of the information.

Category: Wealth Planning