Here are six changes to Social Security for 2022 and how it can affect you. Learn about the COLA increase, Maximum Taxable Earnings changes, and more.

Here are six changes to Social Security for 2022 and how it can affect you.

Cost of Living Adjustment (COLA)

You may see a change in your benefit payments, as Social Security benefits and Supplemental Income will increase by 5.9% in 2022. Social Security bases the COLA changes every year depending on changes in the Consumer Price Index.

According to Social Security, Social Security and SSI beneficiaries are usually notified by mail about their new benefit amount. Most recipients should be able to view their notices online via “My Social Security” account. You may create or access your account by visiting socialsecurity.gov/myaccount.

Maximum Taxable Earnings

The maximum amount of earnings subject to the Social Security tax (taxable maximum) increased to $147,000.

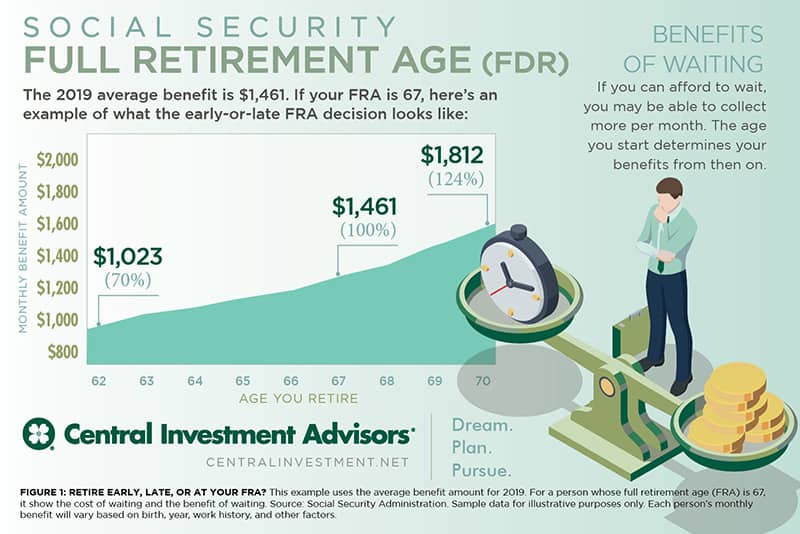

Full Retirement Age

You can claim Social Security benefits as early as age 62, however, if you claim before your full retirement age, your earnings will be permanently reduced. According to the SSA, the full retirement age is 66 if you were born from 1943 to 1954. The full retirement age increases gradually if you were born from 1955 to 1960, until it reaches 67. For anyone born 1960 or later, full retirement benefits are payable at age 67. Use the below chart to see your full retirement age by birth year.

Trying to delay taking Social Security benefits can result in a higher benefit amount for you. If you take Social Security as soon as possible, it’s likely you won’t be able to collect the full amount. By delaying until after your full retirement age, you’ll be eligible for delayed retirement credits which can increase your monthly benefit.

Remember, if you delay your benefits until after age 65, the SSA says you should still apply for Medicare benefits within three months of your 65th birthday. If you wait longer, your Medicare medial insurance (Part B) and prescription drug coverage (Part D) may cost you more money.

Increased Earnings Limit

- The earnings limit for workers who are younger than full retirement will increase to $19,560. The Social Security Administration deducts $1 from benefits for each $2 earned over $19,560.

- If you’ve reached full retirement age, the annual earnings limit for 2022 is $51,960.

- Since the taxable maximum income increased, so does the maximum amount of earnings the SSA uses to calculate retirement benefits. In 2022, the maximum benefit increases by $197 per month to $3,345.

Increased Social Security Disability Benefits

The Social Security Disability Insurance program allows workers to earn coverage by paying Social Security taxes through their paycheck. This can help replace some of the lost income if an individual is no longer able to work. In 2022, the 5.9% increase will boost these benefits as well.

- Disabled workers will earn $1,358 per month.

- Disabled workers, spouses, and one or more children, will receive an average of $2,383 per month.

Credit Earning Threshold

You can qualify for Social Security benefits by earning Social Security credits by working and paying Social Security taxes. According the SSA, you earn credits based on the amount of your earnings. To determine your eligibility for retirements or disability benefits, the SSA uses your earnings and work history. In 2022, you can receive one credit for each $1,510 of earnings, up to the maximum of four credits a year. View this guide on the SSA’s website for more information about earning credits.

To be sure you’re getting the maximum benefits for your situation, be sure to meet with your retirement financial planner. They can help you understand the steps in retirement planning, and will create a personalized financial plan to meet your needs and goals. As always, if there’s any way we can assist you, don’t hesitate to contact us.

Central Investment Advisors are LPL Financial are not affiliated with or endorsed by the Social Security Administration or any government agency. The Social Security Administration provides free Social Security forms, publications and assistance. Neither LPL Financial, nor its registered representatives, offer tax or legal advice. Federal tax laws are complex and subject to change. We recommend you discuss your specific situation with a qualified tax or legal advisor.

Category: Markets & Economy